As one of the world’s largest economies the US is a key focus for investors. With every country attempting to return to normality following the coronavirus pandemic, we are monitoring when US economic activity might get back on track, as well as other measures of “normality” such as entertainment and leisure, high street shopping, and schools reopening. The result is an index that measures progress toward a post-pandemic world.

Our Return to Normal index

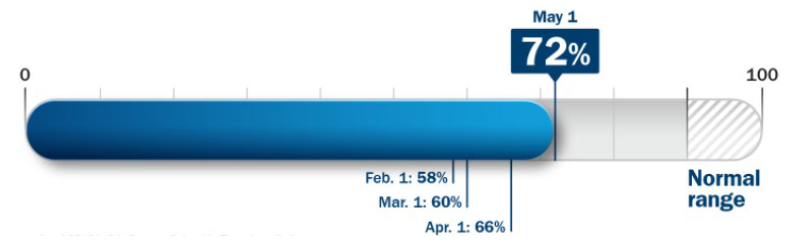

As the US continues its Covid-19 vaccination program, the Return to Normal Index measures human activity data relative to pre-pandemic levels. The index is constructed by our data scientists and fundamental analysts and tracks activities in the US, including travel, returning to work and school, brick-and-mortar shopping and eating out. By design, the index is focused on measuring components of daily life rather than economic indicators such as GDP growth. The percentage level will move closer to 100 as daily life normalises, and our analysts will update it on a regular basis.

What has changed?

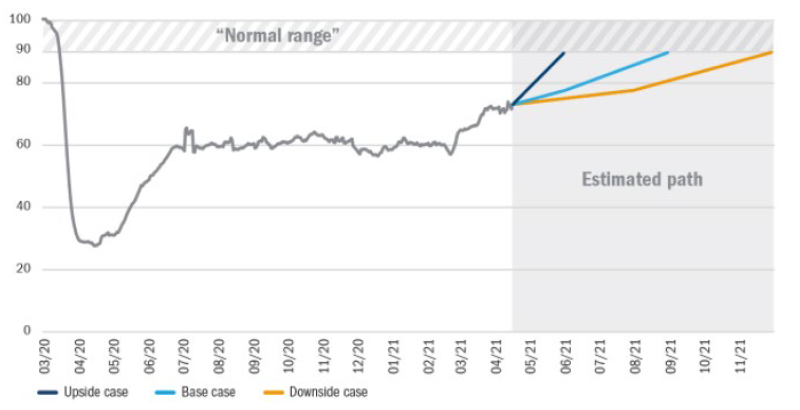

Since our April update, the Return to Normal Index has climbed further, to 72%, fuelled by gains in travel, entertainment and a return to in-person schooling. Now that immunity levels are increasing – through a combination of vaccinations and prior infections – we expect to see a continued decline in active cases over the next couple of weeks. As a base case scenario, we expect the index to advance over the month of May as greater immunity and seasonal factors push activity levels higher. If there are no significant setbacks, the US could reach the normal range by August. We are continuing to watch the data on variants in the US, and if we see a large spike in cases, the momentum carrying the country to our normal range could slow.

Activity numbers won’t all return to where they were before Covid. The index could hit “normal” at a point lower than the 100 level due to continued changes in behaviour, like working from home and reduced business travel. The definition of the future normal is evolving, and the index’s normal threshold will reflect our data science and fundamental research insights.

Figure 1: The Return to Normal Index tracks activity compared with pre-pandemic levels as we progress to post-Covid life

Source: Columbia Threadneedle Investments, 1 May 2021

What are we monitoring, and where is it at?

Figure 2: Tracking inputs

Our index suggests we are still 28% below pre-Covid activity levels. The levels of component activity vary: the return to brick-and-mortar stores is 18% below its pre-Covid level and a normal work routine is 23% below. The subcomponent with the lowest level is travel/entertainment: 43% below pre-Covid levels.

What could drive change?

Figure 3: The Return to Normal Index over time – level as of 1 April 2021: 66%

Source: Columbia Threadneedle Investments, 1 May 2021

Understanding where we are on the path to normal life will be a critical question in 2021. This data can help inform investors’ asset allocation decisions and set expectations on market activity.